A deeply reported work of journalism that explores the promises and perils of microfinance, told through the eyes of international lenders and women borrowers in West Africa

In the mid-1970s, Muhammad Yunus, an American trained Bangladeshi economist, met a poor female stool maker who needed money to expand her business. In an act widely known as the beginning of microfinance, Yunus lent $27 to forty-two women, hoping small credit would help the women pull themselves out of poverty. Soon, Yunus's Grameen Bank was born, and the idea of giving very small, high-interest loans to poor people took off. In 2006, Yunus and the Grameen Bank won the Nobel Peace Prize for "efforts to create economic and social development from below." But there's a problem with this story. There are mounting concerns that these small loans are as likely to bury poor people in debt as they are to pull them from poverty, with borrowers from India to Kenya facing consequences such as jail time and forced land sales. Reportedly hundreds have even committed suicide. What happened? Did microfinance take a wrong turn, or was it flawed from the beginning? Mara Kardas-Nelson's We Are Not Able to Live in the Sky is about unintended consequences, blind optimism, and the decades-long ramifications of seemingly small policy choices. The book is rooted in the stories of women borrowers in Sierra Leone, West Africa. Their narratives, woven through a deep history of modern international development, are set against the rise of Yunus's vision that tiny loans would "put poverty in museums." Kardas-Nelson asks: What is missed with a single, financially focused solution to global inequity that ignores the real drivers of poverty? Who stands to benefit and, more important, who gets left behind?

Book

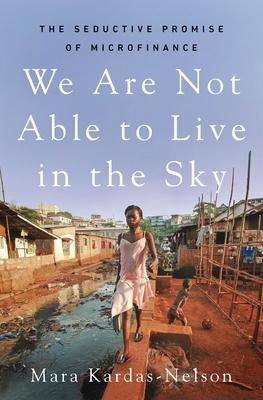

We Are Not Able to Live in the Sky: The Seductive Promise of Microfinance

(Write a Review)

Hardcover

$31.99

A deeply reported work of journalism that explores the promises and perils of microfinance, told through the eyes of international lenders and women borrowers in West Africa

In the mid-1970s, Muhammad Yunus, an American trained Bangladeshi economist, met a poor female stool maker who needed money to expand her business. In an act widely known as the beginning of microfinance, Yunus lent $27 to forty-two women, hoping small credit would help the women pull themselves out of poverty. Soon, Yunus's Grameen Bank was born, and the idea of giving very small, high-interest loans to poor people took off. In 2006, Yunus and the Grameen Bank won the Nobel Peace Prize for "efforts to create economic and social development from below." But there's a problem with this story. There are mounting concerns that these small loans are as likely to bury poor people in debt as they are to pull them from poverty, with borrowers from India to Kenya facing consequences such as jail time and forced land sales. Reportedly hundreds have even committed suicide. What happened? Did microfinance take a wrong turn, or was it flawed from the beginning? Mara Kardas-Nelson's We Are Not Able to Live in the Sky is about unintended consequences, blind optimism, and the decades-long ramifications of seemingly small policy choices. The book is rooted in the stories of women borrowers in Sierra Leone, West Africa. Their narratives, woven through a deep history of modern international development, are set against the rise of Yunus's vision that tiny loans would "put poverty in museums." Kardas-Nelson asks: What is missed with a single, financially focused solution to global inequity that ignores the real drivers of poverty? Who stands to benefit and, more important, who gets left behind?Hardcover

$31.99